Savings Groups: What Are They?

For the last 30 years, the micro!nance industry has been responsible for a massive growth in pro-poor financial services and is estimated to reach more than 150 million people worldwide. Recently, however, a deeper understanding of how the market is segmented has begun to influence the products, methodologies, and delivery channels employed, and engage a wider range of organizations. Many of these organizations do not specialize in microfinance, but focus on serving the very poor—usually those living in remote areas and distressed economic circumstances.

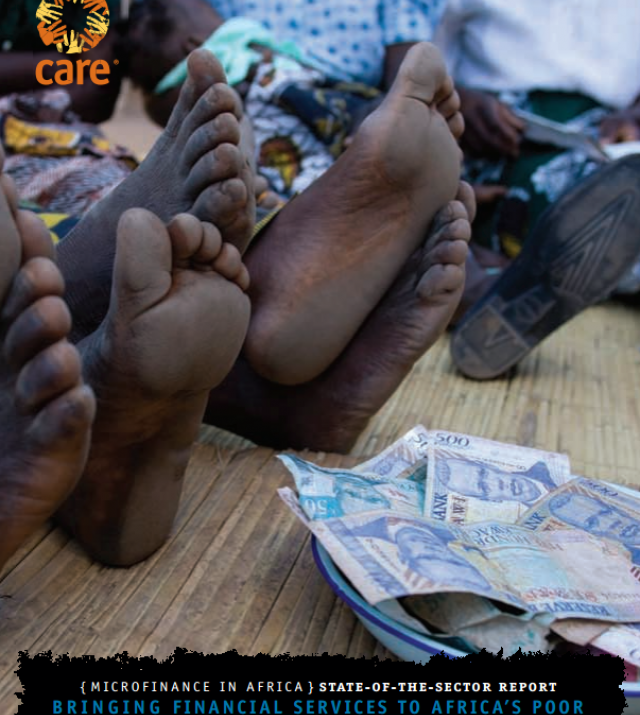

Microfinance institutions (MFIs) and banks have proven highly effective in reaching the near poor, mainly in urban areas, and they perform best when supplying credit to small businesses, whose owners work more or less full-time in their enterprises and are keen to see them grow. It remains true, however, that the least well-served people live in remote areas (and tend to invest in seasonal income-generating activities) or in urban slums. Both of these target groups— whose greatest need is access to useful lump sums to manage household cash-flow—usually have no formal providers able or willing to supply entry-level financial services.

This paper seeks to explore and explain the nature of savings groups and the varying approaches used by the most experienced facilitating agencies (FAs) and projects, which mainly work in Africa.